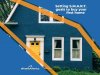

What type of mortgage is right for you?

If you're in the market for a mortgage, you'll want to make sure that you're choosing the right one. There are many different types of mortgages out there, so it's important to understand which ones are best for your situation and what types of loans have better interest rates than others. In this post, we'll go over some of the most common types of mortgages as well as some factors to consider when deciding on which loan is right for you.

Conventional mortgages

A conventional mortgage is the most common type of loan, so it's likely the one you'll be applying for if you're buying a home. Conventional mortgages have no government backing, so they're subject to market fluctuations (like interest rates). They can be negotiated between banks and borrowers--the rates and terms are less standardized than FHA loans.

Conventional mortgages typically require a credit score of 620 or higher in order to qualify for them. For those with lower scores, getting approved may mean having to pay points (a fee) upfront in order to secure your loan terms; otherwise lenders may require larger down payments or higher monthly payments as part of their terms.

Government-backed mortgages

The following mortgages are government-backed:

- FHA loans are designed for people who have lower incomes and/or poor credit scores, but they require a down payment of at least 3.5 percent of the home's value. You can also qualify if you've been denied a conventional mortgage due to your credit score or income level.

- VA loans are designed for veterans. With a VA loan, you can get guaranteed loans with no down payment or mortgage insurance (PMI). However, these mortgages are not available everywhere--check your eligibility before applying!

- THDA loans (through the Texas Housing Development Corporation) offer low-interest fixed rate mortgages with no monthly payments until maturity; however, there is a fee associated with this loan type that ranges between $1,000-$2,500 depending on your income level and credit score.

*Visit hud.gov for more information about different types of government-backed mortgages available nationwide--including FHA/VA/THDA*

Home equity loan

A home equity loan is a second mortgage, or a type of loan that uses the value of your home as collateral. You can use the money for any purpose, including paying off credit cards, student loans and other debts. But be aware: If you default on the loan or fail to make payments on time, your lender will have a claim against your property until they've been repaid in full.

Home equity loans, which borrowers take out against the value of their homes, may come with lower interest rates than other types of mortgages because they're riskier investments for banks: when you borrow against your home's value rather than actually owning it outright (which could happen if you get a traditional mortgage), the bank doesn't have full ownership until after it’s paid off completely.

Refinance with a free mortgage refinance estimate

It's possible that you could be a candidate for a home refinance if:

- Your monthly payment is too high and you can't afford it.

- The interest rate on your loan is too high.

- You're paying off the loan faster than expected.

If any of these situations sound like yours, then refinancing may be an option for reducing costs and saving money in the long run.

An expert can help you determine the best mortgage for you

Mortgage experts can help you understand the different types of loans and how to choose the best one for your situation. They can also help you compare rates, fees, and terms that may affect your monthly payment and overall cost of borrowing.

An expert can also explain how credit scores affect mortgage rates and terms, including whether or not you'll need a co-signer on your loan application.

Reach out to one of our partners in your area to learn more

Getting a mortgage is a big decision, and it's important to understand all of your options before making that decision. Empower yourself with our homebuyer education courses so you can make the best financial decisions for you and your family!

What's Your Reaction?