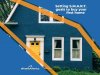

Hidden home ownership expenses you need to be aware of

Owning a home is wonderful, but it can come with unexpected costs. Thinking about finances does not end when you close on your home. There are many hidden expenses that you will have to consider as a homeowner.

Maintenance and Repairs

Owning a home comes with many new responsibilities that you may have never had to consider and requires skills that you may not yet have developed. Whether you hire help or do your own maintenance and repairs, you will be paying a cost. When hiring help, you will obviously pay for the services, as well as sacrificing the time to coordinate and be home to let them in. When DIYing it, you will pay for the materials needed and you will sacrifice your time and energy learning how to fix the problem. Either way, it’s good to know what types of problems can arise.

Moisture

Moisture is sneaky and can cause serious problems, from foundational damage to health complications from the development of mold. If you are unaware of moisture getting into your house, it’s only a matter of time before these problems arise.

Roof

Hopefully, you considered the age and condition of the roof when you purchased your house. The amount of maintenance needed for a roof depends on how old the roof is and how long you live there. Even if you have a brand-new roof, there will always be maintenance and upkeep. Along with many other complications, a damaged roof can increase moisture, leading to other problems previously discussed.

Electric and plumbing

Electric and plumbing systems are very complicated and can be dangerous to fix by yourself. Most likely, during your time as a homeowner, you will need to make a call to the electrician or plumber to resolve an issue.

HVAC unit

An HVAC unit, or heating, ventilation, and air conditioning unit, controls everything from inside temperature to moisture levels. The effectiveness of your HVAC unit can have a direct impact on your energy bills, the amount of moisture in your home, and the livability of your home. HVAC repair is complicated, and depending on the age of the unit, it may need to be replaced, which can be very costly.

Pests

You’ve made a wonderful home for yourself, and now the pests are ready to move in too. Ignoring these little critters can only lead to more serious difficulties. Carpenter bees and termites can eat the wood used to build your house, causing structural damage (not to mention, they’re annoying). Mice and bugs can be eradicated, but sometimes it can take a lot of time and energy, and usually it’s best to leave it to the professionals.

Monthly or annual fees

There are more costs to consider other than the upkeep of your home. If you aren’t informed about monthly or annual fees prior to purchasing a home, it can feel like they came out of nowhere. Knowing about common fees can help prepare you for when those costs arise.

Property Taxes

Homeowners are obligated to pay property taxes annually. Property taxes can vary based on factors like location, type of home, size of home, and efficiency of the home. Property taxes are typically considered when filling out your annual tax report. There are different ways to research property tax rates so you can remain informed about what to expect.

HOA Fees

Some neighborhoods and complexes require HOA fees, or Home Ownership Association Fees. HOA fees usually range from $35-$500 a month, depending on the neighborhood and the role in which the HOA plays. Neighborhoods or complexes with pools, landscaping, extra safety measures, clubhouses, and playgrounds tend to have HOA fees associated. Make sure to ask your realtor to find out what those are prior to purchasing your home.

Insurance

Although having home insurance isn’t a law, banks and lenders require it as a condition of your mortgage. Home insurance is important because it can protect you from natural disasters like fires, hail damage, hurricanes, and more. It can also keep you from being sued if someone were to be injured on your property. Insurance rates are influenced by the same factors that influence property taxes: location, size of the house, age of the house, and efficiency of the house.

Know before you buy

Many people think that once the deal is closed, they are "home free" of costs and fees. Before you purchase a home, make sure you research these factors so you can know what to expect moving forward and budget accordingly. Don’t worry, though; we won’t leave you hanging! Our post-purchase course goes into detail about these factors and how to handle them.

What's Your Reaction?